2025 Form 1094-B Form: A Comprehensive How-to Guide

Understanding the 2025 Form 1094-B

Form 1094-B is a crucial document designed for health coverage reporting, specifically under the mandates of the Affordable Care Act (ACA). This form serves as a transmittal of information to the IRS that outlines the health insurance coverage provided to individuals, ensuring compliance with ACA requirements.

The primary purpose of Form 1094-B is to report on minimum essential health coverage. By collecting and submitting this information, employers, insurers, and other entities help maintain the integrity of health coverage availability across the nation. Non-compliance can lead to significant penalties.

Individuals, families, and small businesses must utilize Form 1094-B if they provide health insurance. However, some exemptions may apply. Certain small employers with fewer than 50 full-time employees and who offer health plans that meet specific criteria can be exempt from filing this form.

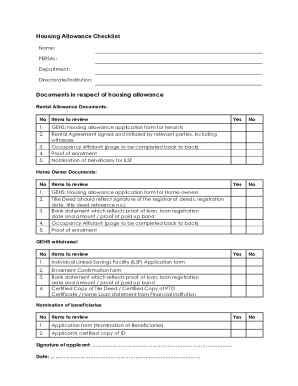

Key components of Form 1094-B

Understanding the key components of Form 1094-B is essential for proper completion. The form consists of several sections, each serving a distinct purpose. The first section focuses on Applicable Large Employer (ALE) information, where you will input data regarding the employing entity and whether they meet ACA definitions.

Section II gathers information about the issuer of the coverage—this could be an insurance company or a self-insured employer. Section III is dedicated to coverage and participant information, detailing the individuals who received health insurance under the reported policy. It's crucial to ensure that all employer details, health coverage terms, and participant identifiers align accurately.

Applicable Large Employer (ALE) Information

Coverage and Participant Information

Step-by-step instructions for filling out Form 1094-B

Before diving into filling out the form, it's essential to gather all necessary information. This includes required documents such as payroll records, proof of previous insurance coverage, and birth dates of covered individuals. Verification of covered individuals is critical to ensure compliance and avoid penalties.

When filling out the sections, begin with Section I by entering the employer’s details. For health coverage periods, ensure you accurately record the start and end dates, as well as the type of coverage. In Section II, you need to input issuer details, including name, address, and employment identification number. Each piece of information must be confirmed for accuracy.

Common mistakes to avoid

Many individuals and organizations can fall into compliance traps due to common mistakes while completing Form 1094-B. Errors such as incorrect data entries involving health coverage dates, wrongly identifying covered individuals, or omitting required signatures can lead to significant non-compliance issues.

It's critical to carefully review your form before submission. Double-check all entries, ensure that all necessary documentation aligns with the presented data, and verify the accuracy of each individual’s covered period to mitigate errors.

Submitting your Form 1094-B

Completing Form 1094-B requires knowledge about its submission methods. You can opt for either e-filing or paper filing, but e-filing is typically faster and preferred by many employers. The submission deadline for 2025 remains critical; generally, it falls at the end of February for paper submissions and early March for e-filed forms.

After submission, expect a confirmation of receipt from the IRS, which indicates that your form has been successfully filed. If rejected, a notification will be provided indicating the reasons, allowing you to make necessary amendments promptly.

Maintaining compliance with Form 1094-B

To ensure ongoing compliance, it's essential to maintain accurate records associated with Form 1094-B. The IRS typically requires these records to be kept for at least three years beyond the filing year. This includes all documentation related to the health coverage provided, employer payments, and communication regarding the coverage.

Watch out for key updates for 2025, as changes may arise from the previous year. Failing to adapt to new requirements can lead to penalties. Always stay informed regarding ACA compliance changes to protect your business and employees.

Utilizing interactive tools and resources

pdfFiller offers an excellent platform for users looking to navigate Form 1094-B with ease. Its document management solutions provide tailored editing features ideal for healthcare forms. The eSigning capabilities ensure that submissions are secure and compliant, enabling seamless collaboration among team members.

Accessing templates and guides on pdfFiller simplifies the process of finding and filling out essential forms, including Form 1094-B. Not only can you edit and manage templates directly on the platform, but there are also additional support features available for users needing additional assistance.

FAQs about Form 1094-B

Navigating the complexities of Form 1094-B can raise many questions. For example, what happens if you miss the submission deadline? Generally, the IRS imposes penalties on late submissions, which is why adhering to timelines is crucial. Additionally, if errors are found after submission, it's possible to amend the form, though it's best to address these promptly to minimize complications.

For further assistance, the IRS provides guidelines and resources, which can be accessed directly via their website. Consulting with tax professionals may also yield specific advice tailored to individual or business needs to avoid compliance pitfalls.

Connecting with professionals for expert guidance

For those uncertain about the intricacies involved in filing Form 1094-B, engaging with tax professionals can provide valuable insight. Signs that you may need expert help include confusion about compliance requirements or if you are managing a large employee base with diverse health coverage options.

The collaboration features available in pdfFiller will also aid in working with experts effectively. Teams can manage document preparation through shared access, ensuring everyone remains in the loop while efficiently completing necessary forms.